Office Equipment Macrs . Macrs depreciation is the tax depreciation system used in the united states. the macrs depreciation calculator allows you to calculate depreciation schedule for depreciable property using modified. macrs is a tax depreciation method for tangible property, assigning specific recovery periods to assets for tax deduction purposes. what is macrs depreciation? we’ll cover its use, key concepts and terms, and the important components of a macrs depreciation. taxpayers can apply macrs depreciation to various asset classes such as automobiles, office furniture, construction machinery, farm buildings, fences,. depreciation using macrs can be applied to assets such as computer equipment, office furniture, automobiles, fences, farm buildings, racehorses, and.

from templates.office.com

what is macrs depreciation? the macrs depreciation calculator allows you to calculate depreciation schedule for depreciable property using modified. depreciation using macrs can be applied to assets such as computer equipment, office furniture, automobiles, fences, farm buildings, racehorses, and. we’ll cover its use, key concepts and terms, and the important components of a macrs depreciation. Macrs depreciation is the tax depreciation system used in the united states. taxpayers can apply macrs depreciation to various asset classes such as automobiles, office furniture, construction machinery, farm buildings, fences,. macrs is a tax depreciation method for tangible property, assigning specific recovery periods to assets for tax deduction purposes.

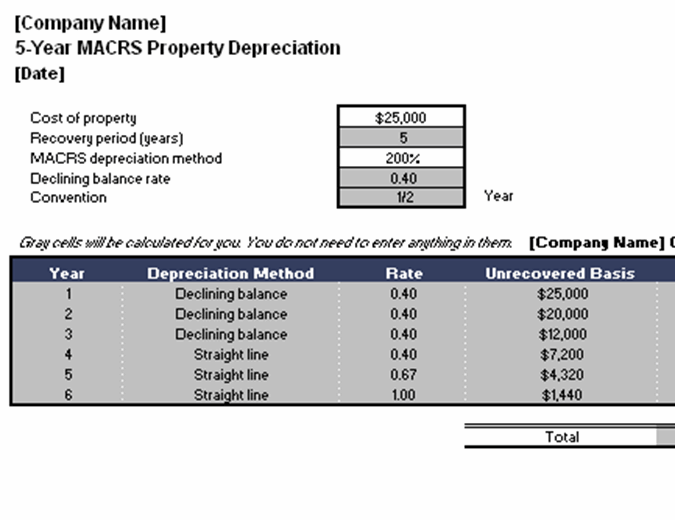

MACRS property depreciation

Office Equipment Macrs macrs is a tax depreciation method for tangible property, assigning specific recovery periods to assets for tax deduction purposes. macrs is a tax depreciation method for tangible property, assigning specific recovery periods to assets for tax deduction purposes. what is macrs depreciation? depreciation using macrs can be applied to assets such as computer equipment, office furniture, automobiles, fences, farm buildings, racehorses, and. we’ll cover its use, key concepts and terms, and the important components of a macrs depreciation. taxpayers can apply macrs depreciation to various asset classes such as automobiles, office furniture, construction machinery, farm buildings, fences,. Macrs depreciation is the tax depreciation system used in the united states. the macrs depreciation calculator allows you to calculate depreciation schedule for depreciable property using modified.

From businesspost.ng

10 Essential Office Equipment You Should Have in Your Office Business Office Equipment Macrs taxpayers can apply macrs depreciation to various asset classes such as automobiles, office furniture, construction machinery, farm buildings, fences,. depreciation using macrs can be applied to assets such as computer equipment, office furniture, automobiles, fences, farm buildings, racehorses, and. macrs is a tax depreciation method for tangible property, assigning specific recovery periods to assets for tax deduction. Office Equipment Macrs.

From www.numerade.com

SOLVED For US federal tax purposes, which of the following properties Office Equipment Macrs taxpayers can apply macrs depreciation to various asset classes such as automobiles, office furniture, construction machinery, farm buildings, fences,. what is macrs depreciation? depreciation using macrs can be applied to assets such as computer equipment, office furniture, automobiles, fences, farm buildings, racehorses, and. we’ll cover its use, key concepts and terms, and the important components of. Office Equipment Macrs.

From officeequipmentsoshikiru.blogspot.com

Office Equipment Office Equipment Macrs Office Equipment Macrs we’ll cover its use, key concepts and terms, and the important components of a macrs depreciation. the macrs depreciation calculator allows you to calculate depreciation schedule for depreciable property using modified. taxpayers can apply macrs depreciation to various asset classes such as automobiles, office furniture, construction machinery, farm buildings, fences,. what is macrs depreciation? depreciation. Office Equipment Macrs.

From slideplayer.com

BBA, MBA(Finance), London, UK ppt video online download Office Equipment Macrs we’ll cover its use, key concepts and terms, and the important components of a macrs depreciation. depreciation using macrs can be applied to assets such as computer equipment, office furniture, automobiles, fences, farm buildings, racehorses, and. Macrs depreciation is the tax depreciation system used in the united states. what is macrs depreciation? macrs is a tax. Office Equipment Macrs.

From fitsmallbusiness.com

MACRS Depreciation Tables & How to Calculate Office Equipment Macrs what is macrs depreciation? macrs is a tax depreciation method for tangible property, assigning specific recovery periods to assets for tax deduction purposes. depreciation using macrs can be applied to assets such as computer equipment, office furniture, automobiles, fences, farm buildings, racehorses, and. we’ll cover its use, key concepts and terms, and the important components of. Office Equipment Macrs.

From www.coursehero.com

[Solved] Baker, Inc., purchases office furniture (7year MACRS property Office Equipment Macrs what is macrs depreciation? depreciation using macrs can be applied to assets such as computer equipment, office furniture, automobiles, fences, farm buildings, racehorses, and. taxpayers can apply macrs depreciation to various asset classes such as automobiles, office furniture, construction machinery, farm buildings, fences,. the macrs depreciation calculator allows you to calculate depreciation schedule for depreciable property. Office Equipment Macrs.

From www.deskera.com

What is MACRS Depreciation? Calculations and Example Office Equipment Macrs macrs is a tax depreciation method for tangible property, assigning specific recovery periods to assets for tax deduction purposes. what is macrs depreciation? we’ll cover its use, key concepts and terms, and the important components of a macrs depreciation. depreciation using macrs can be applied to assets such as computer equipment, office furniture, automobiles, fences, farm. Office Equipment Macrs.

From www.coursehero.com

Penguin Network Warehouse, LLC ("PNW, LLC") acquired the... Course Hero Office Equipment Macrs taxpayers can apply macrs depreciation to various asset classes such as automobiles, office furniture, construction machinery, farm buildings, fences,. we’ll cover its use, key concepts and terms, and the important components of a macrs depreciation. the macrs depreciation calculator allows you to calculate depreciation schedule for depreciable property using modified. Macrs depreciation is the tax depreciation system. Office Equipment Macrs.

From www.numerade.com

Problem 0261 (LO 022, LO 023) (AIgo) Chaz Corporation has taxable Office Equipment Macrs Macrs depreciation is the tax depreciation system used in the united states. depreciation using macrs can be applied to assets such as computer equipment, office furniture, automobiles, fences, farm buildings, racehorses, and. macrs is a tax depreciation method for tangible property, assigning specific recovery periods to assets for tax deduction purposes. we’ll cover its use, key concepts. Office Equipment Macrs.

From www.chegg.com

purchased an office furniture (7year MACRS property) Office Equipment Macrs we’ll cover its use, key concepts and terms, and the important components of a macrs depreciation. taxpayers can apply macrs depreciation to various asset classes such as automobiles, office furniture, construction machinery, farm buildings, fences,. depreciation using macrs can be applied to assets such as computer equipment, office furniture, automobiles, fences, farm buildings, racehorses, and. Macrs depreciation. Office Equipment Macrs.

From cabinet.matttroy.net

macrs depreciation table 2016 Matttroy Office Equipment Macrs we’ll cover its use, key concepts and terms, and the important components of a macrs depreciation. depreciation using macrs can be applied to assets such as computer equipment, office furniture, automobiles, fences, farm buildings, racehorses, and. what is macrs depreciation? macrs is a tax depreciation method for tangible property, assigning specific recovery periods to assets for. Office Equipment Macrs.

From business.amazon.in

Essential Office Equipment List for Buiness Amazon Business Office Equipment Macrs we’ll cover its use, key concepts and terms, and the important components of a macrs depreciation. depreciation using macrs can be applied to assets such as computer equipment, office furniture, automobiles, fences, farm buildings, racehorses, and. Macrs depreciation is the tax depreciation system used in the united states. macrs is a tax depreciation method for tangible property,. Office Equipment Macrs.

From dxoaerbpc.blob.core.windows.net

Standard Depreciation Rate For Office Equipment at Peggy Nisbet blog Office Equipment Macrs what is macrs depreciation? depreciation using macrs can be applied to assets such as computer equipment, office furniture, automobiles, fences, farm buildings, racehorses, and. the macrs depreciation calculator allows you to calculate depreciation schedule for depreciable property using modified. macrs is a tax depreciation method for tangible property, assigning specific recovery periods to assets for tax. Office Equipment Macrs.

From fortmi.com

Office Equipment Meaning, Types, Importance, Uses And Care Of Office Office Equipment Macrs depreciation using macrs can be applied to assets such as computer equipment, office furniture, automobiles, fences, farm buildings, racehorses, and. Macrs depreciation is the tax depreciation system used in the united states. the macrs depreciation calculator allows you to calculate depreciation schedule for depreciable property using modified. what is macrs depreciation? macrs is a tax depreciation. Office Equipment Macrs.

From www.asset.accountant

What is MACRS Depreciation? Office Equipment Macrs taxpayers can apply macrs depreciation to various asset classes such as automobiles, office furniture, construction machinery, farm buildings, fences,. we’ll cover its use, key concepts and terms, and the important components of a macrs depreciation. the macrs depreciation calculator allows you to calculate depreciation schedule for depreciable property using modified. Macrs depreciation is the tax depreciation system. Office Equipment Macrs.

From wealthup.com

MACRS Depreciation Table Guidance, Calculator + More Office Equipment Macrs we’ll cover its use, key concepts and terms, and the important components of a macrs depreciation. macrs is a tax depreciation method for tangible property, assigning specific recovery periods to assets for tax deduction purposes. depreciation using macrs can be applied to assets such as computer equipment, office furniture, automobiles, fences, farm buildings, racehorses, and. Macrs depreciation. Office Equipment Macrs.

From elchoroukhost.net

Macrs Ads Depreciation Table Elcho Table Office Equipment Macrs taxpayers can apply macrs depreciation to various asset classes such as automobiles, office furniture, construction machinery, farm buildings, fences,. Macrs depreciation is the tax depreciation system used in the united states. depreciation using macrs can be applied to assets such as computer equipment, office furniture, automobiles, fences, farm buildings, racehorses, and. what is macrs depreciation? we’ll. Office Equipment Macrs.

From www.youtube.com

MACRS Depreciation HalfYear (HY) Calculation YouTube Office Equipment Macrs what is macrs depreciation? depreciation using macrs can be applied to assets such as computer equipment, office furniture, automobiles, fences, farm buildings, racehorses, and. the macrs depreciation calculator allows you to calculate depreciation schedule for depreciable property using modified. macrs is a tax depreciation method for tangible property, assigning specific recovery periods to assets for tax. Office Equipment Macrs.